HIGH MIX: Apple's American Manufacturing Program, Clash of Trades, Thermal Batteries

Reindustrialization news for August 11, 2025

Welcome to HIGH MIX, our weekly newsletter about the reindustrialization of the United States.

“Apple increases U.S. commitment to $600 billion, announces American Manufacturing Program” APPLE NEWSROOM

Apple’s announcement of a $600 billion U.S. investment commitment over four years is a big deal and somewhat surprising, so let’s discuss the details:

The strategy centers on the American Manufacturing Program (AMP), which incentivizes suppliers through financial support, technical collaboration, and co-development initiatives to relocate or expand operations in the U.S. This is a vertically integrated approach designed to minimize dependencies on overseas fabrication and assembly, reducing transit times, enhancing IP security, and improving iterative design cycles for components like custom A-series and M-series chips.

At the core is silicon and elemental production: Apple is allocating capital to build a comprehensive chain from raw materials to final packaging. Starting with rare earth magnets for device motors and speakers, MP Materials will receive funding to scale facilities in Fort Worth and Mountain Pass, California, incorporating recycling lines to process neodymium from end-of-life products.

This closes the loop on materials, potentially reducing raw import needs by 20-30% based on similar closed-loop models in electronics. For wafers, GlobalWafers America’s Sherman, Texas, plant will expand to produce 300mm silicon wafers optimized for 3nm and below processes, enabling tighter control over substrate quality and defect rates.

Mid-chain investments target fabrication and specialized components: Texas Instruments’ Lehi, Utah, and Sherman, Texas, sites will install new tools for power management and analog chips, while Samsung’s Austin campus focuses on advanced logic nodes. GlobalFoundries in New York handles wireless semiconductors, and Coherent in Texas scales VCSEL lasers for Face ID, which require sub-micron precision to maintain optical efficiency. Applied Materials in Austin will enhance equipment for deposition and etching, critical for 2nm nodes.

Final assembly and packaging see Amkor’s new Arizona facility as the first major customer, using advanced fan-out wafer-level packaging to integrate multiple dies with reduced interconnect losses. Broadcom and GlobalFoundries collaborate on cellular modems, aiming for sub-6GHz and mmWave integration in a single package.

Capital allocation breaks down as follows: roughly 40% ($240B) to supplier expansions and R&D hubs, including the Apple-Corning Innovation Center in Kentucky for Gorilla Glass advancements; 30% ($180B) to domestic fabs and tool installations; 20% ($120B) to training via the Apple Manufacturing Academy in Detroit, opening August 19, focusing on AI/ML for process optimization; and 10% ($60B) to infrastructure like the Houston server facility for Apple Intelligence, starting mass production in 2026, which will handle custom silicon for cloud services.

Technically, this creates a low-latency ecosystem: proximity reduces shipping delays, enabling faster prototyping and defect correction. Quality improves through unified standards—e.g., Corning’s glass optimized for Coherent’s lasers, minimizing optical aberrations.

Overall, this positions Apple as a catalyst for a U.S.-centric tech supply chain, with potential spillover benefits for non-Apple manufacturers through shared facilities and trained talent. Easy to question, of course: when will this scale and how quickly? But a win nonetheless.

“US FDA moves to boost domestic drug manufacturing after Trump push” REUTERS

The U.S. FDA’s launch of the FDA PreCheck program is a two-phase initiative to streamline approvals and construction of U.S. drug plants, responding to Trump’s May executive order that slashed regulatory hurdles and mandated surprise inspections of foreign facilities.

With over half of U.S. drugs sourced overseas and only 11% of ingredient manufacturers domestic, the program promises to enhance supply chain security. But how this unfolds merits close scrutiny.

The mechanics are straightforward. Phase 1 offers pre-submission consultations to guide companies through FDA requirements, while Phase 2 provides real-time support during facility construction and validation, targeting a 30% reduction in approval timelines.

The FDA plans to prioritize 10-15 initial projects, focusing on critical drugs and active pharmaceutical ingredients (APIs), with a goal to approve at least five new plants by 2027. Trump’s order also accelerates Environmental Protection Agency (EPA) permitting, aiming to cut the typical 5-10 year build time in half.

This aligns with recent investments—e.g., Gilead’s $11 billion U.S. expansion and Eli Lilly’s $27 billion factory plans. The shift to unannounced foreign inspections, replacing the prior 2-year COVID backlog, adds teeth to enforcement, potentially leveling the playing field.

Yet, the execution raises questions. The FDA’s resource constraints—hit by recent layoffs and a persistent inspection backlog (e.g., 160 overdue plants in India)—could bog things down. Can a leaner agency handle surging demand without compromising safety?

“Trade Really Did Cost Millions of Manufacturing Jobs in the 00s” CEPR

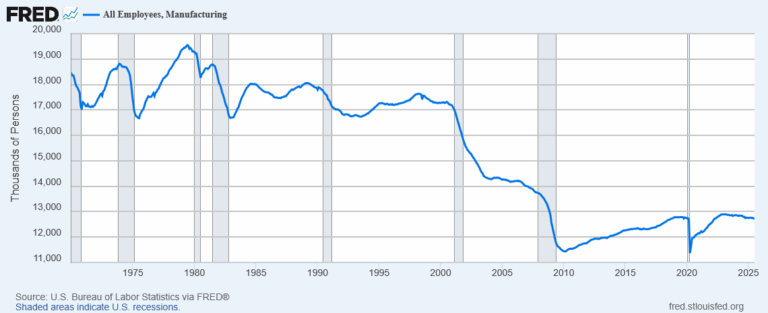

Dean Baker, economist at the Center for Economic Policy and Research (CEPR), challenges the mainstream narrative, asserting that trade, particularly with China, was the primary driver behind the loss of millions of manufacturing jobs in the 2000s.

Baker counters a New York Times piece, arguing that of the six million factory jobs erased that decade, one-sixth (about one million) were directly tied to Chinese imports, with the rest attributed to productivity growth and a shift to service consumption. Baker disputes this, pointing to a sharp employment drop from 17.3 million in 1999 to 11.5 million by 2009, with nearly four million lost pre-recession by 2007, coinciding with a trade deficit peaking at 6% of GDP (over $1.1 trillion today). This correlation suggests trade’s outsized role, but the causal link warrants scrutiny beyond raw numbers.

The analysis hinges on a key insight: productivity growth, often cited as an alternative culprit, likely followed job losses rather than caused them. Baker posits that closing less efficient plants due to import competition raised average productivity, akin to raising a room’s average height by removing shorter individuals.

Getting rid of the least productive plants raises productivity in the same way that pushing the short people out of a room will raise the average height. If we lose the 40 percent least productive manufacturing plants due to import competition, average productivity in the manufacturing sector will increase almost by definition. Rather than being a cause of job loss in the 2000s, rapid productivity growth was the result of the job loss.

However, Baker’s focus on the 2000s as an anomaly, against stable employment trends from 1970-2000, overlooks broader structural shifts like automation, which may have amplified trade’s impact. Baker also notes government policies favoring import-friendly trade deals over professional service liberalization (e.g., doctors’ wages remaining double those in other wealthy nations), yet admits Trump’s tariffs might not reverse this, given manufacturing’s diminished union wage premium (8% unionized vs. 6% in the private sector).

This analysis invites industry insiders to question whether trade policy alone can resurrect manufacturing.

“On a YouTube Show, Making Machine Parts for Glory and $100,000” NYT

Clash of Trades is a nationwide competition where 60 teams from 46 states face off, backed by companies like Boeing and Lockheed Martin. Young fabricators are battling it out with precision welds and CNC cuts, vying for a $100,000 prize.

We need more of this. Shows like “How It’s Made” successfully captivated viewers with the magic of factory floors, while Mike Rowe’s “Dirty Jobs” made a point to highlight the less glamorous, but essential jobs.

“Thermal Energy Storage: The Industrial World’s Hottest Batteries” FORBES

Thermal energy storage (TES) is being pitched as a revolutionary battery alternative for industrial electrification. The core idea—storing energy as heat using cheap materials like salt, concrete, or recycled steel slag—offers a compelling contrast to chemical batteries, boasting 95% efficiency and decades-long lifespans. This could reshape manufacturing by tackling the 70% of industrial energy devoted to heat, aligning with the U.S. push to decarbonize.

The technology’s appeal lies in its diversity: sensible TES (e.g., Rondo’s refractory bricks at 1,500°C), latent systems (MGA Thermal’s metal alloy chips at 700°C), and chemical methods (e.g., slaked lime reactions at 500°C) each target different needs. Rondo’s 200MWh projects and Kraftblock’s 25MW thermal battery for PepsiCo leverage abundant raw materials to sidestep lithium scarcity.

“Palmer Luckey: I Saw the Future of War. Now It’s Up to Us to Prepare for It.” THE FREE PRESS

Palmer Luckey hits the nail on the head—technology is the ultimate battlefield advantage. As the founder of Anduril, Luckey sees a world where AI-driven autonomy, not sheer numbers, will define victory, especially against China’s looming threat to Taiwan. I’m in total agreement with his argument that small, agile teams can outmaneuver bloated bureaucracies; there is a time for scaled systems but they should be in tension with nimble, smaller teams.

He warns that China’s numerical edge—232 times our shipbuilding capacity, the world’s largest missile arsenal—can’t be matched conventionally. Instead, he champions autonomous systems like Anduril’s Roadrunner drones and Dive XL submarines, designed for rapid deployment and mass production using U.S. infrastructure. (As a good arms dealer should.)

A thought: perhaps the lesson of the Ukraine war is not just “drones are a new weapons platform” but that the future of war is rapid technological iteration itself.

“Cybersecurity's Expanding Footprint in the Industrial Renaissance” MANUFACTURING.NET

As manufacturing has become the center of a lot of attention, the spotlight turns to industrial control systems (ICS).

ICS, which manage everything from robotic arms to power grids, are digital nerve centers, blending operational technology (OT) with IT. This convergence opens a Pandora’s box of vulnerabilities. ICS once operated in isolation, air-gapped from cyber threats, but today’s interconnected smart factories—driven by IoT and AI—invite hackers into the heart of production.

ICS encompasses the hardware and software—programmable logic controllers (PLCs), distributed control systems (DCS), and human-machine interfaces (HMIs)—that automate production lines. SCADA, a step above, provides the wide-area monitoring and control, collecting real-time data from sensors across plants or even regions, enabling centralized oversight.

Securing them requires a multi-layered approach. Network segmentation isolates critical ICS components, limiting breach spread, while zero-trust architecture mandates continuous authentication, even for internal devices. Encryption of data in transit and at rest protects against interception, and intrusion detection systems (IDS) monitor anomalies, leveraging AI to flag suspicious activity.

Regular patching and firmware updates too, of course (though this must balance with uptime demands). Physical security—locked server rooms and biometric access—complements digital defenses.

“Industrial Policy and the Tragedy of Intel” WSJ

Intel CEO Lip-Bu Tan’s ties to China are complex. Reports of his investments—via Walden International—in hundreds of Chinese firms, including some linked to the People’s Liberation Army, raise national security red flags. His Cadence tenure saw illegal exports to a Chinese military university, prompting a $140 million fine.

Intel still lags behind TSMC and Nvidia—holding 80% of the AI chip market. Once a leader, Intel’s market share has eroded.

Mr. Tan’s predecessor, Patrick Gelsinger, made a big, costly and so far unsuccessful bet on chip manufacturing. Most competitors focus on chip design, but Mr. Gelsinger sought to compete with TSMC and Samsung in their fabrication. He then lobbied the Biden Administration and Congress to pass the $280 billion Chips Act to finance his bet.

Intel has been the biggest beneficiary of the largesse. Last year the Biden team announced up to $8.5 billion in direct grant funding and $11 billion in low-cost loans. But Intel has had execution problems and has repeatedly delayed construction of a new plant in Ohio owing to weak demand.

WSJ frames Intel’s woes as a “showcase for failed industrial policy”. While there’s certainly a case to be made for policy having an impact here I think it’s worth remembering that it takes two to tango. Intel have clearly done a bad job on their end of the bargain.

Personally, I wouldn’t want Tan running a lemonade stand, let alone a critical U.S. semiconductor company and he should be investigated. But that shouldn’t be a green light for the federal government to dictate who takes his place.