HIGH MIX: California Forever, Reindustrialize Summit, and 800 Hours of Blackouts

Reindustrialization news for July 21, 2025

Welcome to HIGH MIX, our weekly newsletter about the reindustrialization of the United States.

“I went to the 'save America' conference in Detroit, where patriotic founders vied for VC dollars” BUSINESS INSIDER

The Reindustrialize Summit, held at Hudson’s Detroit, makes a case for American manufacturing’s rebirth with defense tech at its core. This year’s event drew over 1,000 leaders—tech innovators, venture capitalists, and military minds—to workshop a vision for industrial dominance.

The summit’s vibe—complete with whimsical “Make American Nuclear Great Again” hats—blended patriotism with pragmatism, and a nod to the past when factories fueled America’s success.

Some highlights included Anduril’s Palmer Luckey—phoning in via a VR-controlled robot—teasing American-made computers, and Hadrian securing $260 million in Series C funding for factory expansion, signaling a surge in defense tech investment.

Reindustrialize did have a handful of detractors. Protesters outside flagged ethical concerns with defense firms like Palantir, and some online critics questioned if venture hype translates into viable outputs.

Rumors (to be taken with a grain of salt) circulated on social media about a mysterious individual wearing a cowboy hat lurking around the event, who allegedly barged his way into private office spaces to take pictures of sensitive information.

Set against our manufacturing rivalry with China, the leaders at Reindustrialize are pushing to retool U.S. production with AI, robotics, and domestic supply chains, ending decades of outsourcing.

Detroit’s industrial legacy loomed large, yet the question remains: can this momentum sustain itself past today’s buzz?

“Billionaire-Backed California City Pitches Plans for Factory Hub” BLOOMBERG

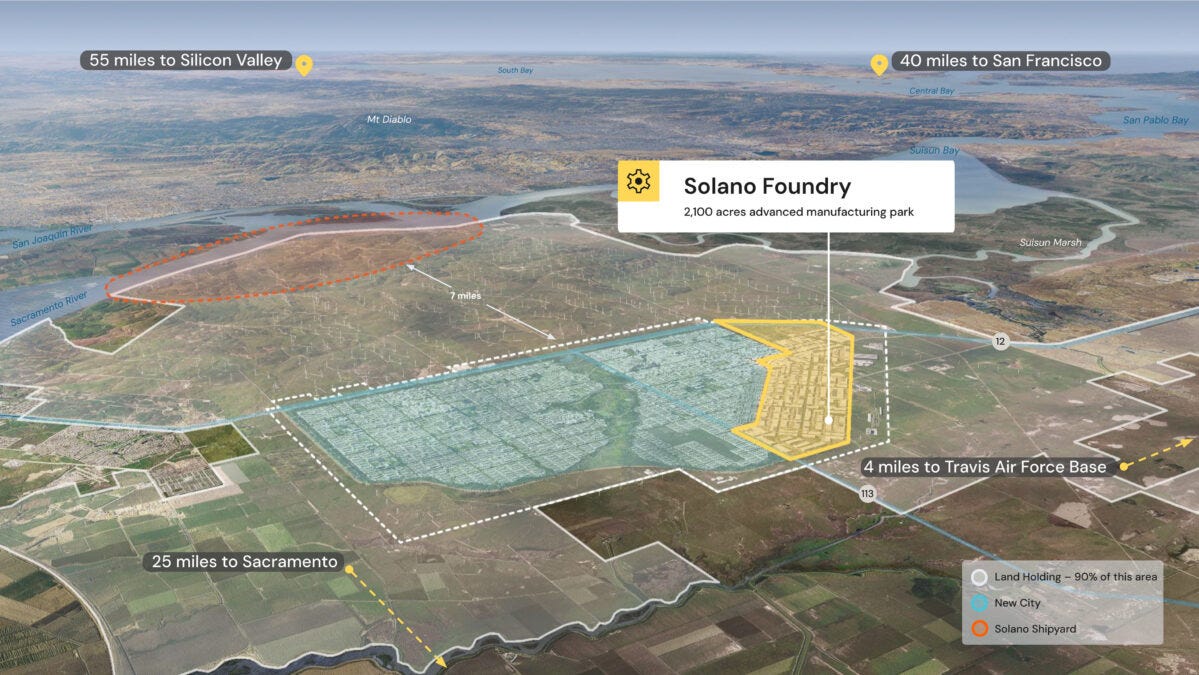

California Forever’s Solano Foundry, a 2,100-acre manufacturing hub on 68,500 acres of Solano County farmland, echoes the "company town" legacy of America’s industrial past—like Pullman, Illinois, where workers lived and worked all within close proximity.

Unlike China’s sprawling industrial complexes, which combine CCP-organized vertical integration with ruthless efficiency, this planned private project blends housing, industry, and amenities into a friendlier California-style self-contained mixed-use zone, leveraging (and probably poaching) Silicon Valley’s nearby talent pool.

California Forever recently entered into a reimbursement agreement with nearby Suisun City, who will annex the property into its district in exchange for funds that will cover the city’s costs related to the program.

Other communities in Solano County like Vacaville might see a transformation too—workers living there could trade long commutes to Sacramento or San Fran for stability.

If it can provide affordable housing and well-paying jobs, Solano Foundry could prove company towns, reborn with modern flair, are beneficial to U.S. manufacturing’s edge over China’s top-down model.

“New York Factory Activity Expands for First Time in Five Months” BLOOMBERG

The Federal Reserve Bank of New York’s general business conditions index leapt 21.5 points to 5.5 (positive numbers indicate growth), fueled by a surge in orders and shipments.

Economists have been rather pessimistic with predictions of continued stagnation—in fact, none of Bloomberg’s economists predicted growth—but this data says otherwise.

It’s a signal that U.S. manufacturing in general might be clawing its way back from the doldrums. And with 12% of the state’s workforce in this sector, it’s extremely important for New Yorkers that Buffalo and Rochester are humming with life again.

Love a good comeback story, but let’s not pop the champagne yet. This index has been a rollercoaster—down to -11.7 in February, now up to 5.5—and input costs have climbed 3% since June.

Things are tight for factories already dealing with thin margins. I hope manufacturers in New York can keep this trend going with the rest of the country following suit.

“Apple is investing $500 million in a US maker of rare earth magnets, and the company's stock is soaring” BUSINESS INSIDER

Apple dropped $500 million into MP Materials this week to secure U.S.-made rare earth magnets for its gadgets, and MP’s stock climbed another 25% on Tuesday.

The deal teams Apple with the only U.S. rare earth mine operator to recycle neodymium magnets from old iPhones, and they’re building a new factory for it in Texas.

Tim Cook is hyping it as a win for American innovation, and with the Pentagon tossing MP $400 million last week, it’s a boon for MP and a step in the right direction for Apple who are all-too-reliant on China.

Unfortunately, China still lords over 90% of rare earth processing, and this is still a drop in the bucket in comparison. Analysts whisper MP might be overvalued too, with an eye-watering PE ratio of 36X. (They’re clearly doing a lot right, but also essentially the only domestic company in-sector.)

The recycling angle’s clever, turning scrap iPhones into new iPhones, but can a half-billion dollar deal really put a dent in our dependency on China? I think it can if other tech companies and domestic rare-earth providers follow suit, and maybe they’ll feel they have a green light to do so with Apple taking the first leap.

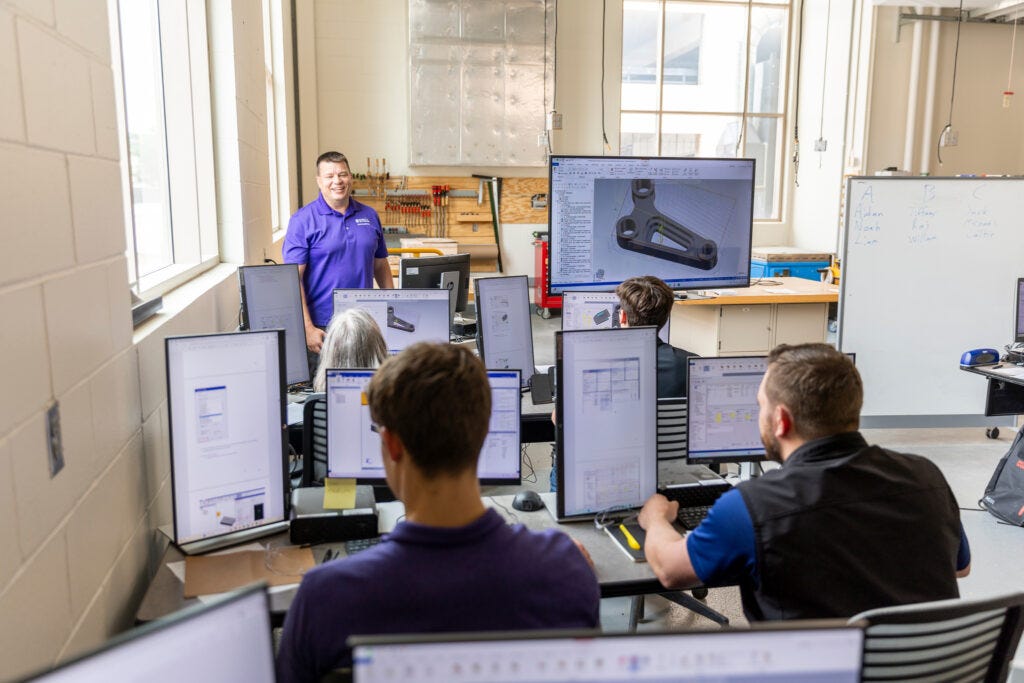

“University of St. Thomas Offers No-Cost Machining and CNC Optimization Training” UNIV. OF ST THOMAS

The University of St. Thomas launched the Machining AdvantEdge program this week, offering free CNC optimization training to bridge the skills gap.

“This training is about more than just software or machines. It’s about empowering people with the confidence and tools to change the way they approach CNC programming and manufacturing in general,” said Dr. Tiffany Ling, clinical faculty in mechanical engineering and operations director for manufacturing workforce development at St. Thomas. “In collaboration with our industry partners, we’re creating opportunities for machinists and engineers to upskill with digital tools that directly translate to better performance, faster production, and smarter decision-making on the shop floor.”

Partnering with the Air Force Research Laboratory and Third Wave Systems, it delivers a self-paced online course and two-day bootcamps (August 25-26 and 27-28) to upskill machinists and engineers. More sessions will be available next year.

With 600,000 manufacturing jobs unfilled, this initiative could sharpen U.S. competitiveness in a sector hungry for talent.

“Optimized dual NURBS curve interpolation for high-accuracy five-axis CNC path planning” NATURE

A new study suggests an optimized dual NURBS curve interpolation method can be used to enhance five-axis CNC path planning with sub-micron accuracy—down to 0.1 μm.

That’s a bit of a mouthful, but I’ll attempt to explain:

Traditional NURBS (non-uniform rational basis spline) interpolation often stumbles with sharp curvatures, but this innovation splits the curve into two synchronized segments, enhancing stability at high machine speeds—resulting in up to 15% faster processing.

This algorithm is great for complex surfaces such as turbine blades, reducing machining errors by 30% through a dual-curve approach that smooths tool paths and minimizes jerk. The method’s real-time adaptability, tested on a Siemens Sinumerik 840D, cuts computational load by 25%.

This leap forward challenges outdated CNC limitations, enabling tighter tolerances and more options for things like aerospace and automotive parts.

“Energy Department Report Raises Blackout Risks from AI and Increased Electrification if Current Utility Plans Continue” IER

A stark Department of Energy report warns that U.S. power shortages could spike by 2030 if current utility plans persist, threatening not just heavy industries but the entire grid in general.

Driven by things like AI data centers and automotive electrification, demand could soar—adding 35 to 108 gigawatts by decade’s end, with 50 gigawatts tied to data centers alone.

The grid faces a simple math problem: 104 gigawatts of firm generation (coal, gas, nuclear) are slated for retirement over five years, while only 200 gigawatts of new capacity—mostly wind and solar—enter the mix. This mismatch could inflate blackout risks 100-fold, per DOE projections, from 8 hours to 800 hours annually.

The DOE’s 100-fold risk estimate hinges on unchanged plans, and it overlooks certain new arrangements like nuclear restarts (e.g., Three Mile Island, 2027 target). Still, increasing reliance on intermittent renewables raises eyebrows. It’s true that wind and solar can’t deliver “firm power” output, needing backup power storage off peak production hours that’s lagging to scale. And while battery-based backup options are growing, they’re far from the scale yet needed.

For manufacturing hubs, where AI datacenters and power-hungry factories collide, this is a wake-up call to rethink energy infrastructure foundations.

The challenge is clear: adapt or the future is dark.

“New AI model could revolutionize U.S manufacturing” NATIONAL SCIENCE FOUNDATION

The National Science Foundation unveiled MaVila—a new AI model that aims to transform U.S. manufacturing. This new tool, developed by California State University Northridge’s Autonomy Research Center, blends image analysis and natural language processing to “see” factory flaws, suggest fixes, and adjust machines in real time.

Trained on manufacturing-specific data via NSF-funded high-performance computing (HPC) systems, MaVila needs far less data than typical AI, potentially leveling the field for small firms. Its debut marks a shift from AI’s dominance in medicine and finance, targeting the precision and timing demands of factories.

MaVila takes a different approach. Instead of relying on outside data, like information on the internet, it is trained with manufacturing-specific knowledge from the start. It learns directly from visual and language-based data in factory settings. The tool can "see" and "talk" — analyzing images of parts, describing defects in plain language, suggesting fixes and even communicating with machines to carry out automatic adjustments.

So, what makes this system better than existing options?

MaVila’s edge lies in its lean data needs and real-time adaptability compared to other solutions like IBM’s predictive maintenance, which relies on vast amounts of sensor data to forecast machine failures. SAP’s AI-driven digital twins offer virtual process optimization, but MaVila’s language-to-machine commands add a unique layer, potentially cutting setup times. Appinventiv’s AutoML solutions automate workflows, yet lack MaVila’s vision-language synergy, which sounds fairly user-friendly and could streamline small-firm adoption.

It’s not a direct apples-to-apples comparison, though; IBM and SAP leverage broader ecosystems, while MaVila’s niche focus might limit scalability. But if MaVila scales well it could streamline a lot of stuff, potentially making the case that targeted AI trumps generic approaches.

“Free trade ‘essential’: China’s He Lifeng warns Western reshoring threatens supply chains” SOUTH CHINA MORNING POST

China’s Vice-Premier He Lifeng took to the podium at the third China International Supply Chain Expo, bleating about how Western reshoring—fueled by tariffs and “de-risking”—jeopardizes global supply chains.

“Some countries are currently intervening in the market in the name of de-risking, using measures such as additional tariffs and restrictions to promote so-called ‘manufacturing reshoring’,” He said at the opening ceremony of the third China International Supply Chain Expo on Wednesday.

“The redundant development of industrial and supply chains has reduced the overall efficiency of the global economy.”

“Free trade remains an essential requirement for world economic development... There are no winners in tariff wars or trade wars.”

Don’t buy the sob story. Reshoring’s disruption is intentional, shaking loose a subsidized, state-backed model built on forced tech transfers and IP theft—practices He conveniently ignores. China’s export diversion to Vietnam and Mexico can’t offset the 21% U.S. shipment drop in April, a trend He’s desperate to downplay.

This is a power shift, not a crisis.

With $1.2 trillion in U.S. incentives, reshoring could claw back 10% of global manufacturing by 2030, leaving China in the dust. He’s betting on bluster, but his warnings are more about saving face than saving supply chains.

“Tariffs or not, automation is still key to reshoring manufacturing” MANUFACTURING DIVE

HowToRobot’s Søren Peters makes the argument that tariffs may prompt reshoring, but automation is the real driver of sustainable manufacturing success.

U.S. firms reported 287,000 jobs from reshoring and foreign direct investment in 2023—a 26-fold jump since 2010 and well before tariffs were even considered an option. Peters points to an 88% rise in industrial robots as the backbone. He cites a case where a U.S. manufacturer slashed automation costs by $1.8 million, over 50% of the original price, by tackling edge cases.

Peters downplays how China’s robot density—outpacing the West—relies on state subsidies we can’t match, giving them a head start. His optimism hinges on 1,100 U.S. system integrators, but finding the right partners amid a rush to reshore could be a challenge.

Peters is onto something, though: tariffs are a sideshow. The real battle is in the remaking of factories—existing or net new—where smart automation could outlast policy swings if we close the skills gap and expertly deploy advanced robotics and automation.