HIGH MIX: Electron Showers, Green Steel and Manufacturing Success

Reindustrialization news for August 4, 2025

Welcome to HIGH MIX, our weekly newsletter about the reindustrialization of the United States.

“What constitutes manufacturing success?” BROOKINGS

Brookings Institution’s Darrell West’s latest analysis offers a framework to measure what constitutes manufacturing success in this era of revival.

He outlines ten key indicators: increased employment, higher output, improved productivity, favorable trade agreements, reduced trade deficits, increased foreign investment, alleviated worker shortages, greater use of domestic parts, a stable dollar, and enhanced tariff revenues.

These metrics provide a lens to evaluate the impact of current policies, particularly under the Trump administration’s tariff and tax strategies, building on prior efforts like the CHIPS Act and Obama-era AI robotics initiatives.

With manufacturing employment at 12.8 million jobs in 2025, up from a low of 11.5 million in 2010, the sector shows signs of recovery, supported by a 47% increase in output since 2005, according to West’s data.

Employment growth is evident, with 414,000 job vacancies reported in May 2025, reflecting an upward trend in demand that could require 3.8 million additional workers by 2035, half of whom may need to be new entrants due to an aging workforce.

Productivity, however, remains a mixed bag, with annual growth fluctuating between 1% and 2% since 2015, a modest gain compared to historical peaks.

80% of Americans support expanding manufacturing, though only 20% are willing to join the workforce, highlighting a disconnect. Foreign investment is on the rise, while domestic parts usage is increasing, though exact figures are still emerging.

The push for tariff revenues and a stable dollar aligns with recent policy moves, but West cautions that success hinges on addressing labor shortages, worsened by reduced federal funding for community colleges and immigration policy shifts affecting 3.2 million foreign-born workers.

Looking ahead, the potential is significant. West suggests that emerging technologies, such as AI and advanced robotics, could drive further gains, with reshoring efforts potentially boosting manufacturing’s economic contribution.

However, the reliance on a skilled workforce and stable policy implementation remains critical.

“Why Ford’s Made-in-America Strategy Hurts It in Trump’s Trade War” WSJ

With 25% tariffs on auto imports since April, you’d think U.S. auto production would be cheaper than importing assembled vehicles by now, but no—Ford’s facing a staggering $2 billion hit this year, thanks to reliance on foreign parts and imported aluminum.

Toyota’s RAV4 from Japan, subject to a new lowered 15% tariff deal, undercuts a Michigan-built Ford Escape by $5,000. GM, with its more diverse supply chain, also weathers the tariff impact better than Ford.

Ford said that the new 15% rate is too low to motivate competitors to move production to the U.S. “Japan and South Korea have real advantages in labor costs, materials and currency,” the company said. “Meanwhile, Ford is facing billions due to multiple tariffs on auto parts, steel, aluminum and more that increase our costs of building in America.”

The United Auto Workers and a trade group representing Detroit’s automakers have criticized Trump’s move to lower tariffs. “U.S. trade policy should push automakers to build in America, with skilled, union labor,” the UAW said. “A flat 15% tariff doesn’t accomplish that.”

It’s hard to believe that with these new import tariffs a company building cars here is worse off than one shipping them in. The disparity’s wild.

Ford’s U.S. plants lean on imported aluminum—key for its F-150’s lightweight frame—now hammered by 50% tariffs. The WSJ notes Japan’s tariff deal spares its supply chain, while Ford’s current supply model amplifies costs for every bolt.

Put simply: it’s still cheaper to manufacture vehicles overseas in this particular rotation of the tariff prism. GM’s Mexico and Canada plants soften the blow. Steel-heavy imports like the 4Runner thrive, while Ford’s aluminum-reliant U.S. production costs much more—surprising, right?

“Startup Claims Its Green Steel Will Be Cheaper Than Regular Steel” BLOOMBERG

Hertha Metals—a Bill Gates and Vinod Khosla-backed startup—claims it can outprice conventional steel with “green steel”, suggesting it can be a game-changer for domestic supply chains.

Hertha’s pilot plant in Texas produces one ton daily using a novel one-step process, slashing carbon emissions by over 50% with renewable electricity and natural gas, and plans a 9,000-ton output demonstration plant by 2031.

Cheaper, cleaner steel could greatly benefit U.S. manufacturing, reducing reliance on imports and bolstering reshoring efforts. It would certainly be nice to use local steel for cars, bridges, and defense, all with a green badge.

But let’s not get ahead of ourselves. Their optimism hinges on unproven scalability—one ton a day (or even 9,000 tons) is a drop in the bucket against the 86 million tons the U.S. consumes yearly.

Hertha’s cost advantage is theoretical until that plant’s online. The startup’s claim of outpricing conventional steel ignores entrenched competitors like Cleveland-Cliffs, which canceled a $500 million green project, signaling market skepticism in this type of venture.

“America's growing copper crisis finds a promising solution in Arizona's backyard” FOX BUSINESS

Ivanhoe Electric’s Santa Cruz mine in Casa Grande aims to be the first new U.S. copper mine in over a decade, targeting production by 2028 with 3 billion pounds over 23 years.

Their eight-year timeframe from planning to production—thanks to the mine’s position on private land in Arizona—is extremely short compared to the average 29-year permitting process that’s typical for a new copper mine.

With demand soaring—26 million tons in 2024, projected to hit 40 million by 2050—this is a strategic linchpin. Trump’s March executive order and 50% import tariff are attempting to fast-track the shift to U.S. production.

It’s absolutely crucial to secure domestic copper supply, as the U.S. produces just half of what it needs.

“Tax credit could boost competition among Gulf coast ports” FREIGHT WAVES

The Port Crane Tax Credit bill, introduced by Republican lawmakers including Reps. Mike Ezell, Jen Kiggans, and Nicole Malliotakis, aims to incentivize domestic production of port cranes, critical to securing supply chains and enhancing port capabilities.

With Chinese-built cranes facing tariffs, the credit provides an alternative.

The bill is already stirring interest. Ports like Pascagoula, Mississippi, and Gulfport see this as a chance to close infrastructure gaps—Pascagoula lacks cargo cranes, limiting its diversification, while Gulfport wants to create skilled jobs. Port Tampa Bay, which uses Chinese cranes installed in 2016, supports the credit to address national security concerns and shift toward American-made equipment.

The proposed tax credit “is exactly the kind of forward-thinking support Gulf Coast ports like ours need to stay competitive and meet the demands of a modern, American-made supply chain,” said Port Pascagoula Port Director Bo Ethridge.

“As manufacturing continues to return to U.S. shores, our port is experiencing increased demand and new growth opportunities. Yet we remain the only major Gulf Coast port without cargo cranes, which is an infrastructure gap that limits our ability to diversify commodities. This legislation is a vital step toward closing that gap.”

The American Association of Port Authorities backs this as a step toward reshoring key container handling gear, with Gulf Coast ports eyeing increased competitiveness against rivals like Houston and New Orleans, which rely on Chinese cranes. The credit could attract investment, aligning with the growing demand from returning manufacturers.

“Trump Ends Tariff Break for Low-Value Goods in Blow to Online Retailers” BLOOMBERG

This latest executive order scraps the $800 duty-free threshold, hitting retailers like Shein and Temu that flooded the market with foreign-made trinkets.

With 309 million de minimis shipments this fiscal year, the White House calls it a loophole exploited for cheap imports and even fentanyl smuggling.

But this is an opportunity for U.S. manufacturers to step up, crafting low-cost goods that rival those overseas prices while (ideally) delivering superior quality.

The potential is there. American factories, with modern automation and skilled labor, can produce everything from apparel to small electronics at competitive costs. One example is the Carolinas—one of the largest textile hubs in the country—where quality control exceeds China’s mass-production.

It’s not that we can’t do it, we just need much more of it to satisfy consumer demand.

Businesses can pivot to domestic production, leveraging tax incentives from the One Big Beautiful Bill Act to offset initial costs. Higher standards can set U.S. goods apart, building trust and longevity over disposable imports.

“OECD Supply Chain Resilience Review” OECD

The OECD Supply Chain Resilience Review offers a compelling framework for rethinking how supply chains affect reshoring in an era of global uncertainty.

At its core, the report argues that resilience isn’t about eliminating risks but mastering them through collaboration—public, private, and international partnerships. It emphasizes policy tools like trade facilitation, digitalization, and data analytics to foster agility, adaptability, and alignment, countering a fragile international trading system. For the U.S., this could mean reducing logistics frictions and enhancing service trade, aligning with efforts to reshore critical industries.

This approach invites reflection. The report’s call for a holistic system focus—beyond just securing supply—suggests that overemphasizing localization, as some advocate, might miss the mark. It highlights that resilience strategies should address routine disruptions with firm-level risk management while relying on governments for extreme shocks, a dual-track model.

How effectively can U.S. policymakers balance open markets with economic security, especially as tariffs reshape trade flows?

The emphasis on digital tools and data capacity is promising, yet it prompts curiosity about infrastructure readiness—can aging ports and grids keep up with the pace?

The review’s vision is a roadmap, not a guarantee—its success hinges on practical implementation and global cooperation, offering a chance to redefine supply chain strength as America’s industrial base rebuilds.

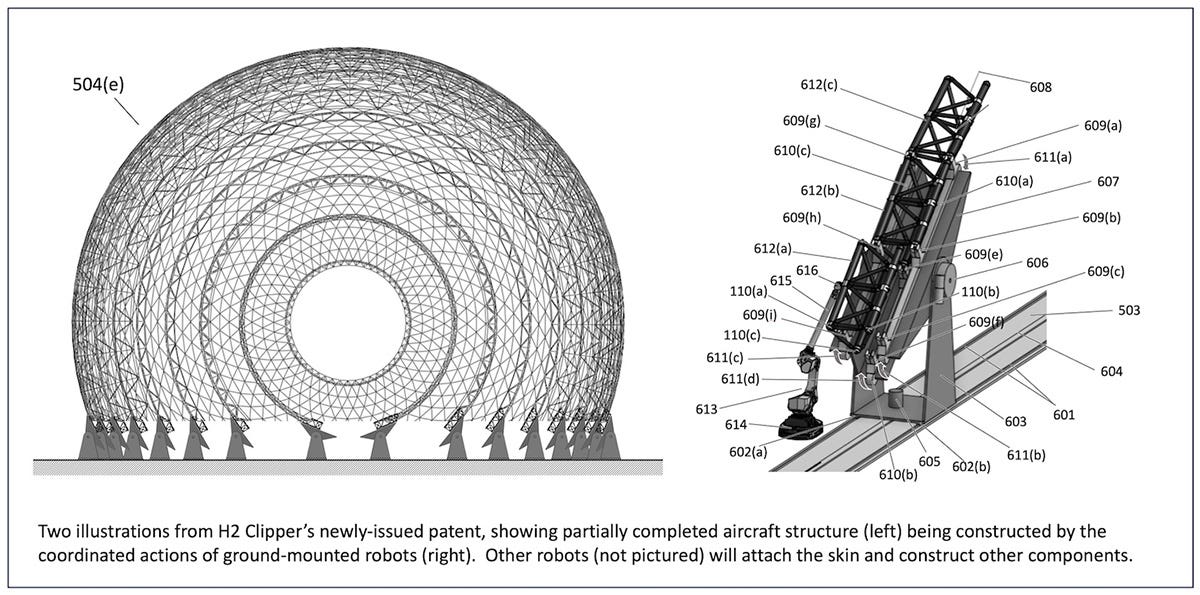

“Swarm robotics could spell the end of the assembly line” THE ROBOT REPORT

Swarm robotics are a potential upgrade to traditional aerospace assembly lines, a concept championed by Rinaldo Brutoco of the World Business Academy.

This technology leverages Level 3 generative AI to enable self-coordinating robot swarms, patented under U.S. 12,234,035, to construct complex structures like aircraft and spacecraft.

There could be significant advantages: a 40% reduction in production costs and a 60% acceleration in timelines, driven by adaptive, decentralized task execution.

This shift from Henry Ford’s linear model to a dynamic, AI-orchestrated system raises critical questions about its feasibility, particularly in aerospace—a sector with tight tolerances.

Energy consumption for thousands of autonomous units (and their backend compute power), maintenance logistics, and integration with existing production lines remain unaddressed variables.

Brutoco’s assertion that aerospace could lead this transition due to its complexity is plausible, yet the transition’s success hinges on robust testing and infrastructure support. [Lovely concept that seems wildly disconnected from any near-term reality. —Ed.]

“The “Electron Shower” That’s Revolutionizing Microchip Manufacturing” SCI TECH DAILY

What if the future of microchip manufacturing hinges on a fleeting burst of electrons? Synchronized Floating Potential HiPIMS (SFP-HiPIMS), developed by Empa researchers, is turning heads.

This process uses an “electron shower” to charge substrates negatively for a split second, accelerating ions to create high-quality piezoelectric thin films—key for RF filters in smartphones and beyond.

Unlike traditional methods, it works on insulating substrates at low temperatures. Could this unlock new possibilities for flexible electronics or even quantum tech? The precision of timing ion pulses intrigues me—how fine can that control get before imperfections creep in?

The technology’s promise is tantalizing. By syncing magnetron pulses with the electron shower, researchers like Sebastian Siol achieve films as effective on glass as on conductive surfaces, hinting at broader applications. But how scalable is this?

Scaling to mass production for billions of devices might take a while—I wonder if energy demands or equipment costs pose barriers.

“The dirt from an old fab shop tells stories” THE FABRICATOR

Step into Barnes MetalCrafters’ old shop in Wilson, N.C., and you can probably feel the history. The company, now housed in a new facility since 2019, faces the task of deciding the fate of a building over half a century old.

The air inside is thick with metal dust and time, layers of grime caked into every crack, a testament to decades of hard work.

As workers cleared out, stories emerged—their own memories, but also from unexpected visitors drawn to the scrap pile, including a police investigator mistaking it for stolen goods.

Of all the moments, though, one hit harder than the rest. Tucked in the corner of the shop were the old food and water bowls that belonged to my dog, Copa. She was our shop dog for years. She came to work every day, greeted every customer (unless she was napping), and was part of our crew. Seeing those bowls all aged and dusty was like getting punched in the gut by a memory. She was the best dog we could’ve ever asked for, and her presence is one of the many layers in that shop’s history.

The story of Copa, gone but not forgotten, serves as a reminder that the workshop where countless Americans spend their lives is worth cherishing.