HIGH MIX: Heat Pumps, Sovereign Wealth Funds and Right to Repair Laws

Reindustrialization news for August 25, 2025

Welcome to HIGH MIX, our weekly newsletter about the reindustrialization of the United States.

“Installing Heat Pumps in Factories Could Save $1.5 Trillion—and 77,000 Lives” MOTHER JONES

Let’s contemplate a bold proposition: replacing 33,500 conventional combustion-based boilers in U.S. factories with industrial heat pumps.

The technology’s mechanics are both elegant and complex. Industrial heat pumps manipulate refrigerant pressure to extract heat from external air or waste streams, amplifying it to meet factory needs—e.g., heating water to 200°F for beverage pasteurization. Unlike gas boilers, which burn fossil fuels and emit pollutants, heat pumps are three to five times more efficient, leveraging existing heat rather than creating it from scratch.

These heat pumps, scaled-up versions of residential units, use electricity—ideally from renewables—to transfer heat rather than generate it, targeting low- and medium-temperature industrial processes like food processing and paper production. The American Lung Association’s report underscores a dual benefit: slashing greenhouse gas emissions (1.6 billion tons of CO2 by 2050) and curbing toxic pollutants like nitrogen oxides (NOx) and PM 2.5’s, which cause respiratory issues and cancer.

Low-to medium-temperature applications (up to 300°F) is their sweet spot, with models already on the market from companies like GEA and Mayekawa. However, high-temperature processes (above 500°F, common in steel or chemical plants) remain unaddressed, as these pumps are still in development.

If implemented across the board, it could be a $1.1 trillion health cost savings and $351 billion in climate damage avoidance, driven by reduced asthma attacks (33 million) and lost workdays (3.4 million).

It may sound a bit farfetched to replace all boilers with heat pumps (and it is near-term, although companies like Atmos Zero are working on it), but thinking on this kind of scale gives us an idea of what to expect as technology progresses and it potentially becomes the preferred choice going forward.

Additionally, upfront costs—estimated at $10,000-$50,000 per pump depending on size—pose barriers for small manufacturers. Retrofitting existing boiler systems adds complexity, requiring electrical upgrades and space reconfiguration, while state funding (e.g., New York, California) covers only a fraction of needs.

“How a Sovereign Wealth Fund Could Reindustrialize America” COMMONPLACE

The premise of a U.S. sovereign wealth fund (SWF) is compelling: decades of underinvestment in strategic sectors like critical minerals and semiconductors have eroded U.S. industrial capacity, with national security and economic costs now glaringly evident.

Unlike resource-rich nations like Norway or Saudi Arabia, the U.S. lacks trade surpluses or commodity windfalls, facing a $30 trillion debt and chronic deficits.

Private capital’s high hurdle rates—often exceeding returns in capital-intensive industries—leave a gap that public funding must fill, Julius Krein argues, citing China’s state-backed dominance as a wake-up call.

The proposal hinges on unconventional financing. Krein suggests leveraging public assets—potentially revaluing the Treasury’s $900 billion gold reserves—or expanding the Pentagon’s Office of Strategic Capital (OSC) to crowd in private investment. This could fund a broad portfolio, from AI to minerals, de-risking projects to attract capital.

Yet, there are risks: revaluing gold might spook markets, and OSC’s defense focus could skew priorities, neglecting civilian industries. Krein envisions a fund that scales production without relying on future appropriations, using leverage to amplify impact—potentially commanding resources far beyond initial funding. Without clear investment criteria, it risks becoming a political tool, as seen in Turkey’s “parallel budget” model.

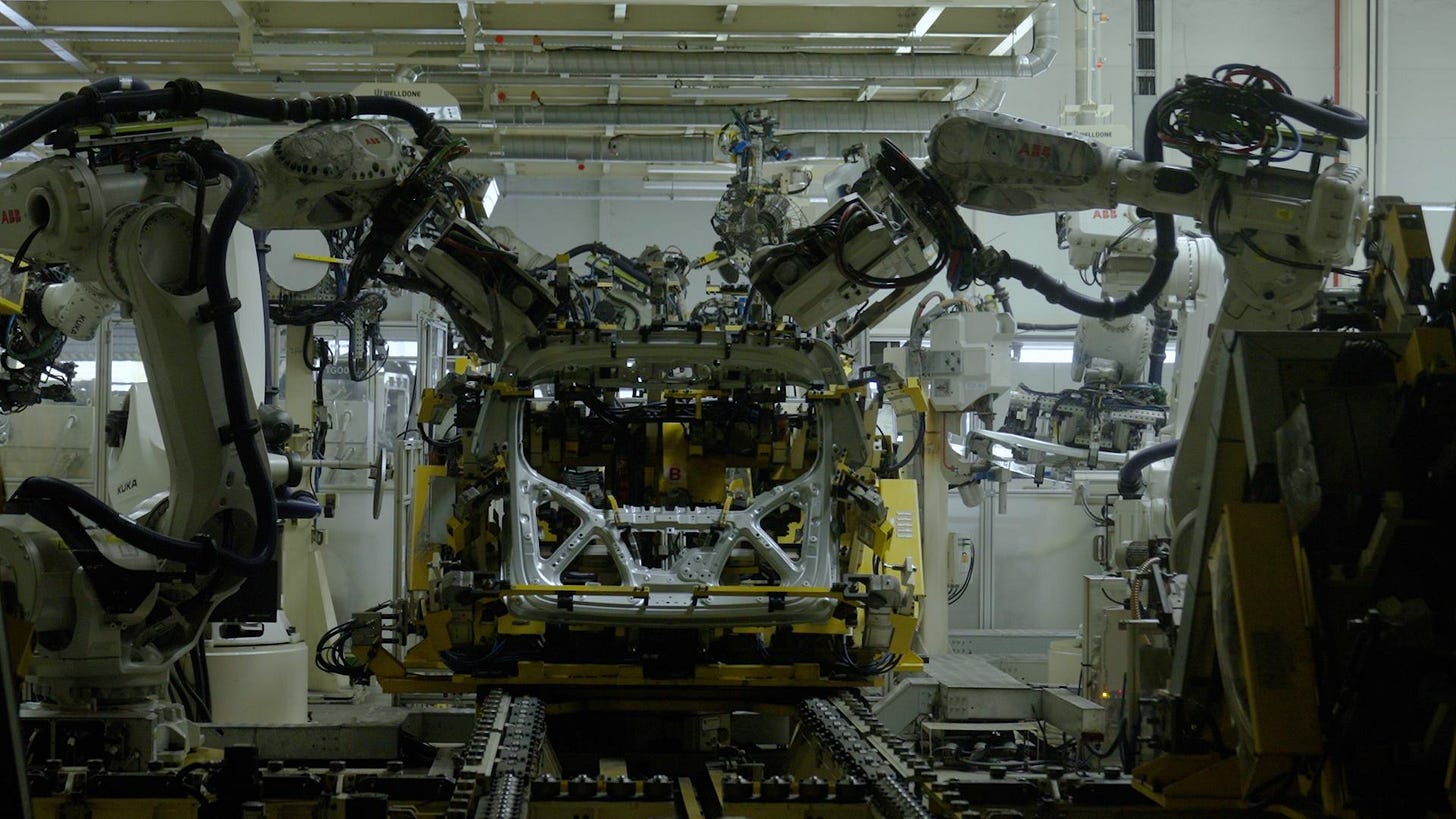

“More And More Chinese Factories Are Going “Lights Out.” Should We Be Worried?” FORBES

China’s “lights out” factories—operating without human intervention—are widening the manufacturing gap with the U.S., raising valid concerns for America’s future. But I’m not exactly worried yet.

These facilities, exemplified by Zeekr’s automated lines, leverage robotics in contrast to human-dependent U.S. plants, where high SKU volumes and frequent product switches limit full automation. Ethan Karp notes China’s edge in repetitive production, driven by state subsidies, while U.S. factories thrive on flexibility—a contrast that could undermine reshoring efforts.

Karp rightly points out that U.S. manufacturers can’t replicate China’s lights-out model due to diverse production needs, suggesting a hybrid approach with humans and robots. He cites Zeekr’s reliance on workers for tasks like cable assembly and robot maintenance.

China’s lead in scale and state support (e.g., cheap loans, land) just barely outpaces U.S. private-sector agility. Without actionable steps, the article feels like a call to worry rather than act, a missed opportunity to guide us forward.

To bridge this gap, the U.S. must get creative. Just spit-balling here: why not expand tax credits for robotics adoption, targeting small-to-mid-sized manufacturers to democratize tech access? Launch a national apprenticeship program, partner with tech firms to train workers in automation and AI, addressing the skills deficit. Renegotiate trade deals to secure affordable raw materials—e.g., steel and copper—mitigating tariff-induced cost spikes. The list goes on, but hand-wringing about China’s progress will get us nowhere.

“Some AI assembly required: This startup wants to make US manufacturing easier than following an Ikea manual” BUSINESS INSIDER

At the core of this new Siemens-Dirac partnership is Dirac’s BuildOS, a software tool that transforms complex CAD (computer-aided design) files into interactive, step-by-step assembly instructions. This AI-driven system eliminates the labor-intensive manual process—where engineers once took hundreds of screenshots and compiled them into lengthy PowerPoint guides—by autonomously determining the optimal assembly sequence.

Integrated with Siemens’ Teamcenter engineering management software, this collaboration promises to enhance precision and efficiency, but the technology’s intricacies reveal both promise and hurdles.

The technology hinges on advanced AI algorithms, likely autoregressive models, though Dirac’s CEO Fil Aronshtein keeps the specifics under wraps. BuildOS processes 3D CAD data, analyzing geometric relationships and material properties to generate a logical assembly order, ensuring stability and minimizing errors.

The system outputs interactive guides—dynamic 3D visualizations with real-time annotations—accessible via tablets or augmented reality headsets, guiding workers or robots through tasks, which sounds futuristic and perhaps even fun to use. Siemens’ integration with Teamcenter adds a layer of data synchronization, pulling design specs and feeding assembly data back into the digital twin ecosystem, enabling continuous optimization.

It’s all very cool tech but integrating AI into legacy systems requires substantial upfront investment, and the 18-person Dirac team may struggle to scale support across diverse machinery types.

“Right-to-Repair Laws Gain Momentum” ASSEMBLY

Right-to-repair laws are gaining bipartisan traction, with broad implications for factories as end users of machinery which is often locked down by the OEM.

With all 50 states filing legislation and 24 actively debating it this year, these laws grant access to parts, tools, and diagnostics, breaking the OEM monopoly that often leaves end users at the mercy of costly service contracts. The article cites Deere & Co.’s new digital service tool, spurred by an FTC lawsuit, as a sign of progress.

I’m all in—farmers and factories deserve this autonomy to cut costs and resolve issues they’re equipped to handle, and the establishment’s safety-focused pushback can be addressed with proper training, not restrictions.

Right-to-repair laws would let in-house technicians access diagnostic codes and replacement parts, slashing downtime from weeks to days and saving millions annually.

The concern about intellectual property is valid but solvable in my opinion through regulated access, as Deere’s tool demonstrates.

“Trump’s tech deals break with U.S. traditions of free enterprise” WASHINGTON POST

Alongside deals with Apple, Nvidia, and AMD, this intervention—announced Friday—marks a shift where the government entangles itself in private tech, supposedly to counter China’s dominance.

The administration hails it as a national security triumph, with Trump touting it as a “great deal” after pressuring Intel CEO Lip-Bu Tan. But is this a masterstroke or a slippery slide toward some kind of State Capitalism, undermining the very market it claims to protect?

Now, a 10% stake isn’t total control, but the mechanics raise red flags. The Intel deal converts CHIPS Act grants into equity, giving the U.S. a foothold in a company struggling to ride new trends such as the AI chip market. There have been other similar moves—Nvidia and AMD paying 15% of revenues from Chinese markets, Apple under tariff pressure—suggesting a pattern of government leverage over corporate strategy.

Proponents argue it secures domestic production, like Intel’s (very delayed) Ohio fab, but the rosy narrative ignores risks. Taxpayers foot the bill for a faltering firm, while Tan’s retention despite China ties (e.g., investments in PLA-linked firms) smells of political expediency over principle. The cheerleading glosses over how this could distort market competition, favoring Intel over nimbler rivals like TSMC.

“How 60,000 military name tapes are made each month in a Fort Knox factory” BUSINESS INSIDER

“Manufacturing roundtable addresses critical workforce challenges” BG INDEPENDENT NEWS

A manufacturing roundtable hosted by the Center to Advance Manufacturing, a collaboration between Bowling Green State University, the University of Findlay, and Owens Community College, is tackling critical workforce challenges in northwest Ohio.

The discussion, involving industry leaders, educators, and officials like U.S. Rep. Bob Latta, centers on attracting and retaining talent, shifting the outdated “dark, dirty, and scary” perception of manufacturing, and navigating automation and immigration policy impacts.

Talent scarcity looms large, with participants like Bill Steel of Bard Manufacturing lamenting Ohio’s struggle to retain young workers who chase glitzier careers elsewhere.

“How do you make manufacturing sexy? How do you make Ohio sexy?” asked Bill Steel

Ohio’s sexiness aside, the roundtable calls for collaboration, better resource communication, and mindset shifts among competing firms, with the Center tailoring support—upskilling, tax credit navigation, or educational partnerships—to each manufacturer. BGSU President Rodney Rogers emphasizes adaptability and problem-solving skills for a tech-driven future, and initiatives like the New Jersey Manufacturing Skills Initiative.

“'I learned so much' — Attendees laud first Apple Manufacturing Academy in Detroit” APPLE INSIDER

Apple’s first Manufacturing Academy in Detroit launched on August 19 in partnership with Michigan State University (MSU). This two-day program, part of Apple’s $500 billion U.S. investment pledge, is intended to equip small and medium-sized businesses (SMBs) with advanced manufacturing skills.

Attendees from diverse sectors—packaging, eyewear, and 3D printing—praised the hands-on training and networking, however, the two-day format and initial cap on participants feels a bit meager to me.

They do offer one-on-one consultations and plans for virtual courses later in 2025, focusing on project management and process optimization. There are also free workshops covering machine learning, deep learning, automation, and data-driven quality enhancement, led by Apple engineers and MSU experts.