HIGH MIX: Texas-Built Icebreakers, Toxic Plumes, and How Detroit's Past Impedes Its Future

Reindustrialization news for June 16, 2025

Welcome to HIGH MIX, our weekly newsletter about the reindustrialization of the United States.

We’re back from a quick trip to Detroit last week, where we recorded a brace of new podcasts from the Newlab building on the Michigan Central campus that we’ll be releasing alongside new episodes over the next month.

Detroit remains such a synecdoche of the American manufacturing core: literally full of machinery, engineers, wisdom and ambition, while almost in stasis because of its legacy successes.

The Detroit challenge in particular is that the dominant manufacturing industries are too big to incorporate new ideas from startups or new suppliers quickly—and when they do it is rarely as a customer. This makes Detroit an incredible place to build a hard tech or tooling company when it comes to access—to engineering talent (yes, including software), warehousing and real estate, processed materials—but paradoxically a challenging place to grow an early-stage company’s sales. (Especially outside of automotive.)

In between podcasts, I spoke to many of my friends and colleagues I know from my old days as one of the strategists working on the EV transition, many of whom remainin leadership positions at the Big 3 or working in the “innovation” space, about the investments that are being made to make Detroit a great place to start a hard tech business.

My refrain remains simple: Until Detroit and Michigan can grow a new company that creates a new market globally—until Detroit makes its first non-automotive billionaire—it will continue to lag behind cities that make the progression from early-stage startup to early-revenue company easier.

It’s a cultural problem: the power of Detroit has been weighted towards automotive for a century. Legacy can be fuel, but in Detroit’s case it’s an anchor. Every time someone in Michigan talks about what its people are building today, they start with a speech about its manufacturing might of the past. Stop doing that.

I remain bullish on Detroit and Michigan, but it needs a new identity that looks towards a future more focused on manufacturing, materials, and engineering prowess in general than the “mobility” industry. (“Mobility” being shorthand in Detroit for “things with wheels aren’t cars that won’t hurt our car sales.”)

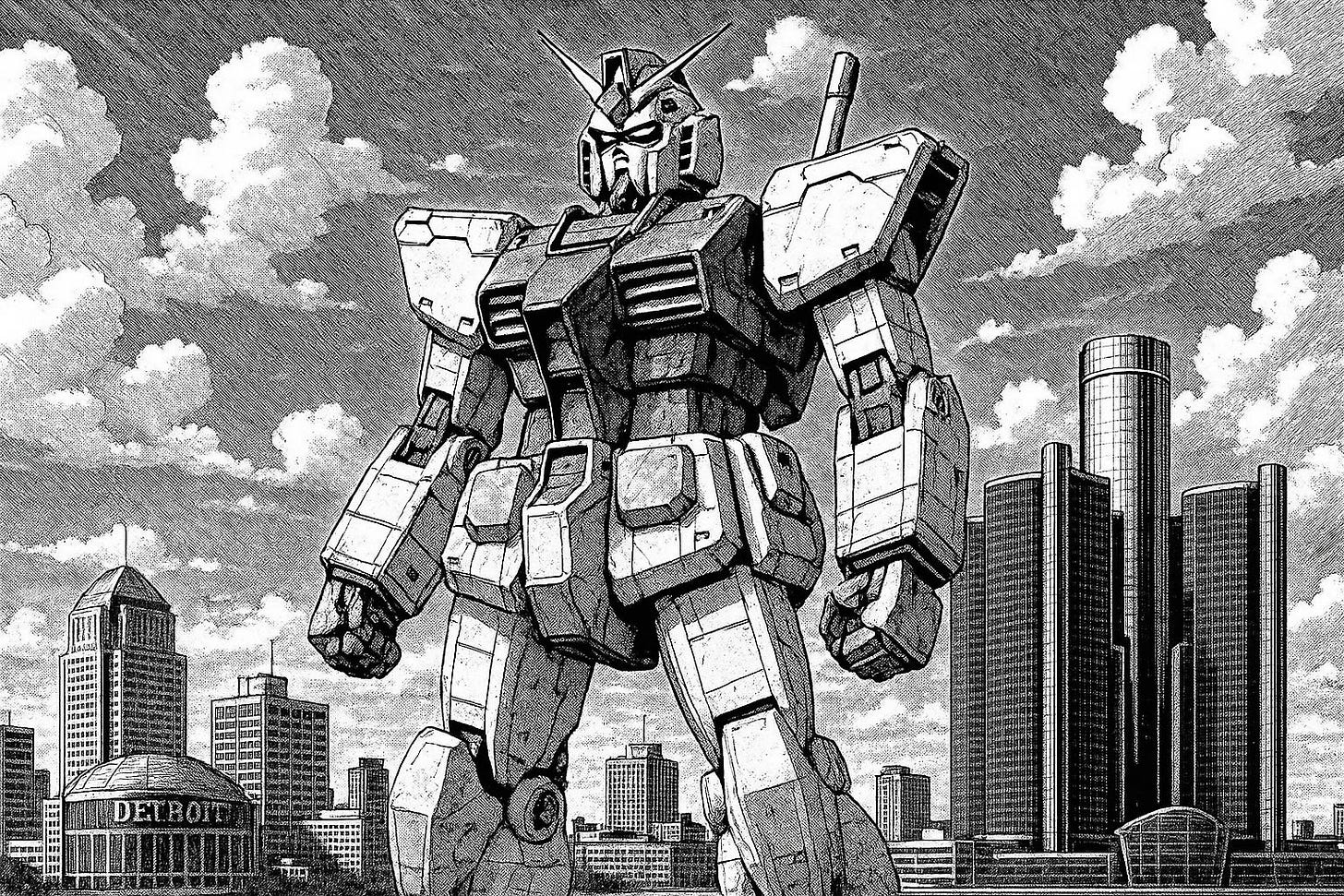

In short: Yes, Michigan must design, create, build and pilot the world’s first fully operational Gundam. And you know what would be a great first step in doing that? Becoming the western hemisphere’s largest supplier of electric motors of every size. — Joel

”Wittmann helps ITW do more with less space” PLASTICS MACHINERY & MANUFACTURING

Can an injection molding shop grow and add new equipment without increasing its footprint? ITW Deltar Fasteners—makers of headrests for Ford and Toyota—used a combination of new Whitman “Insider Package” machine and a “we can just do it in CAD” attitude to maximize square footage while cutting costs and waste.

“We took drawings of each one of our molding machines, laid them all out in CAD and laid out our entire production floor in CAD, including the uprights for our cranes, where our stanchions are — where everything is — then laid out how we wanted our floor plan. We had to move every single molding machine in the plant — and we did it all in nine months,” [manufacturing engineer Phil Dunn] said.

They also cut their workforce from “50…down to about 26 right now” with increased automation. That’s half of a good thing: manufacturers should always be chasing efficiency. The other half will be when increased demand for its products and capabilities allow them to grow enough to support more than 50 employees.

Not to pick on ITW specifically, but automation without growth in manufacturing is one factor that created the capabilities plateau America has today: suppliers reach a certain size, can’t afford to build a skills ladder for its team, and more often than not shut down when their owners sell or move on.

“U.S. Manufacturing Reshoring and FDI Top 244,000 Jobs; 2025 Outlook: Potentially Strong but Dependent on Stable Industrial Policy” RESHORING INITIATIVE

The Reshoring Initiative’s 2024 Annual Report gives a useful baseline snapshot already underway in 2024, well before the new administration’s trade policy was formalized:

In 2024, U.S. manufacturing reshoring and foreign direct investment (FDI) remained strong, driven by companies seeking to shorten supply chains, reduce exposure to geopolitical risks, and avoid costs associated with impending tariffs. In early 2025, global supply chains are grappling with uncertainty. Data from the Reshoring Initiative offers timely in-sight into how companies are responding to the changing environment.

Some key findings from the report:

• Reshoring by U.S. headquartered companies outpaced FDI by foreign headquartered companies by the largest margin on record in 2024.

• High-tech industries are driving growth: 88% of 2024 jobs were in high or medium-high tech sectors, rising to 90% in early 2025.

• Industries leading in 2024: Computer & Electronics, Electrical Equipment (including EV batteries and solar), and Transportation Equipment. 👏 BRING 👏 THE 👏 PHONES 👏 HOME 👏

• Texas, South Carolina, and Mississippi are top 2025 states for reshoring and FDI.

• Asia remains the largest source of reshored + FDI jobs, while South Korea, China, and Germany led among individual countries.

• Tariffs are now a key motivator: Cited in 454% more cases in 2025 vs. 2024. Government incentives cited 49% less as previous subsidies phase out. (We’ve talked previously about how it appears the tariffs—as stick, carrot, or just fear of uncertainty—have been roughly 50/50 in their impact on reshoring versus delaying manufacturing builds on U.S. soil by foreign companies.)

• Workforce constraints loom large: U.S. manufacturing apprenticeships rose 83% over the past decade, but far more skilled workers are needed to sustain reshoring growth.

“With tariffs and taxes, Wisconsin manufacturers are at a critical crossroads” MILWAUKEE JOURNAL SENTINEL

In the short term, tariffs are increasing raw or processed materials costs—it’s painful for smaller shops with tight margins. For businesses who can afford to wait, long term benefits of reshoring should negate the additional overhead by generating more demand for products made in the USA.

Tariff supporters say the import fees shield American industries from unfair foreign competition that’s harmed them for more than 30 years. For some companies, new tariffs will create opportunities to win back work they lost to overseas competitors decades ago.

Despite the optimism, inconsistent trade policies and messaging have some company execs spooked:

"Manufacturers simply cannot make a commitment if they don't know what the playing field looks like," said Austin Ramirez, CEO of Husco International, a Waukesha-based manufacturer for the automotive industry.

This is the current moment in a nutshell. A generational shift towards incentivizing restoring and expanding American manufacturing is simultaneously being slowed by the uncertainty of the administration’s timelines.

Sure, maybe the tariffs rope-a-dope are all part of Trump and Bessant’s 3D chess to unwind 70 years of a certain type of global order for another one. But even so: predictability needs to be folded back into the landscape soon or even the most optimistic manufacturers will be pointlessly hobbled.

“As US trade truce gets back on track, some Chinese exporters are 'slowly dying'“ REUTERS

American manufacturers aren’t the only ones under duress from the trade war. Chinese producers of low-end electronics, household goods and other easily-made products are the worst hit—some are selling at a loss or not paying their workers at all in an effort to prolong their survival.

The growing pressure on companies to sell at a loss or to cut wages and jobs to stay afloat gives Washington a pain point to press Beijing in coming weeks and months as talks continue between the two sides to rebalance their trade relationship.

"If it lasts more than three or four months, I think many of these small and medium-sized enterprises will not be able to bear it," said Zhiwu Chen, chair professor of finance at the University of Hong Kong.

"This is definitely a bargaining chip for the United States."

Good.

“Toxic chemical leak at Ohio explosives plant prompts no-fly zone, mass evacuations” NY POST

Something you never want to see: an orange plume of nitric acid.

About 3,000 gallons of nitric acid was released from an enormous tank at the Austin Powder Red Diamond Plant in McArthur – which manufactures explosives used for mining and construction – around 8:30 a.m. Wednesday, a Vinton County spokesperson told WLWT.

In the infamous words of BlendTec inventor Tom Dickson: “Don’t breathe this.”

THE SECTION IN WHICH WE PRAISE THE BIG BEAUTIFUL FACTORY INVESTMENTS

“Aerospace Startup JetZero to Start Building Futuristic Planes in North Carolina” WSJ

North Carolina—home of the Wright brothers’ first flight—will make aviation history again as the location of JetZero’s new Z4 aircraft production facility.

The Z4’s spacious fuselage and blended-wing design is radically different from what’s currently available from Boeing or Airbus, and could improve fuel efficiency by up to 50%. (The planned factory sounds impressive; I can’t wait to see how they’ll make this thing.)

The Long Beach, Calif.-based company said it would break ground next year on a manufacturing plant in Greensboro, N.C., ultimately investing nearly $5 billion. The factory will employ more than 14,500 workers, the company said, making it North Carolina’s largest-ever jobs announcement. It puts JetZero on track to start rolling out its space-age looking, blended-wing airplanes for commercial use by 2032.

“Amazon to spend $20B on data centers in Pennsylvania” ABC NEWS

One data center is being built next to northeastern Pennsylvania's Susquehanna nuclear power plant. The other will be in Fairless Hills at a logistics campus, the Keystone Trade Center, on what was once a U.S. Steel mill.

The majority owner of the Susquehanna nuclear power plant, Talen Energy, announced last year that it had sold its data center to Amazon for $650 million in a deal to eventually provide 960 megawatts. That's 40% of the output of one of the nation's largest nuclear power plants, or enough to power more than a half-million homes.

“GM plans $4B investment to boost US manufacturing” MANUFACTURING DIVE

American carmakers are hurriedly boosting manufacturing capacity in the US in response to reshoring initiatives—most of them have recently announced major investments of some kind. GM’s latest venture will ramp up production in Michigan, Kansas and Tennessee.

“We believe the future of transportation will be driven by American innovation and manufacturing expertise,” said Mary Barra, GM Chair and CEO, in the release. “Today’s announcement demonstrates our ongoing commitment to build vehicles in the U.S and to support American jobs.”

Yes.

“GlobalFoundries Announces $16B U.S. Investment to Reshore Essential Chip Manufacturing and Accelerate AI Growth” GF PRESS RELEASE

GF is collaborating with major technology companies such as Apple, SpaceX, AMD, Qualcomm Technologies, Inc., NXP and GM, that are committed to reshoring semiconductor production to the U.S. and diversifying their global supply chains. These companies partner with GF to support their production of U.S.-made chips, underscoring GF’s role as a trusted supplier of essential semiconductors and a key enabler of supply chain security.

Yes!

“Texas Shipyard Deal Would Bring Arctic Icebreakers Trump Seeks” WSJ

USCGC Polar Star

If the US Department of Defense wants to dominate arctic shipping routes, it needs more icebreakers. We currently only have two aging, ‘70s vintage Polar-class icebreakers in service with the Coast Guard—and a third, larger nuclear-powered vessel USCGC Healy—which aren’t enough to secure new shipping lanes emerging in the arctic.

Canadian shipbuilding firm Davie are in negotiations to buy shipyards around Galveston and Port Arthur, Texas to start producing American-made arctic-ready ships.

Trump earlier this year signed an executive order aimed at reforming the U.S. maritime industry and ramping up production of commercial and military vessels. In a speech to Congress in March, he said America had fallen behind in shipbuilding, but “we’re going to make them very fast, very soon.”

This comes amid Congressional efforts to pass the Shipbuilding and Harbor Infrastructure for Prosperity and Security (SHIPS) for America Act, which would significantly increase American shipbuilding capacity.

You know who we should talk to about this? Brian Potter of god-tier Substack Construction Physics.

MAGNETS, MOTORS, DRONES

“Ford CEO Says Rare Earth Supply Is ‘Day to Day’ After Plant Halt” BLOOMBERG

[Ford CEO Jim Farley] said he is pleased with the progress he read about from trade talks between the US and China recently, but he has yet to see an improvement in the flow of magnets. Those are used throughout vehicles to power components such as windshield wipers, seats and audio systems.

“We have applications into Mofcom and they are being approved one at a time,” Farley said, referring to China’s ministry of commerce. US President Donald Trump said that fresh negotiations with China this week yielded an agreement for Beijing to swiftly approve export licenses for rare earths.

The magnet supply chain crisis may be at the forefront now, but magnet production was off-shored decades ago. Indiana-based bonded neodymium-iron-boron (NdFeB) magnet manufacturer Magnequench—a defense contractor and former subsidiary of General Motors—was bought by a shady investment firm and subsequently moved production to China:

In 1995, Magnequench was purchased from GM by Sextant Group, an investment company headed by Archibald Cox, Jr-the son of the Watergate prosecutor. After the takeover, Cox was named CEO. What few knew at the time was that Sextant was largely a front for two Chinese companies, San Huan New Material and the China National Non-Ferrous Metals Import and Export Corporation. Both of these companies have close ties to the Chinese government. Indeed, the ties were so intimate that the heads of both companies were in-laws of the late Chinese premier Deng Xiaopeng.

Magnets were the subject of many of our conversations in Detroit last week and will be something we dive into further on the podcast. There is good news on the horizon about domestic magnet supply (stay tuned), but the rare earth processing facilities need to be funded and built yesterday. Which western state government wants to become “The Home of Rare Earths”?

“Crayola’s CEO On Building A Colorful Past Into A Creative Future” FORBES

Let’s talk supply chain strategy. The mantra of what we’ve been doing since 2007 has been to develop a capability that gives us competitive advantage of close-to-market responsiveness. The idea of us being able to respond and forecast the demand in critical seasons is an advantage that we enjoy over our competitors. Specifically, if we’re talking about concentration of a business model in North America, having 1.7 million square feet of under-roof automated equipment scale, we make 3 billion crayons a year in Easton, Pennsylvania. We make three quarters of a billion markers. We make 100 million jars of paint. It keeps growing. To be able to make that here in the U.S. makes the tariff situation more palatable.

“Resiliency” isn’t just a wartime word.

“Trump Orders Restrictions Slashed on U.S. Drones” WSJ

By some estimates, there are 73 manufacturers in the US producing either Unmanned Aerial Systems (UAS) or their components. The heavy hitters are companies with defense contracts—or making heavy-payload drones for industrial, cinematic and agricultural applications—but a handful of firms like ARK Electronics, Skydio and Parrot Anafi USA aim to fulfill the needs of the American consumer drone market.

It’s a good start, but we need more US-based consumer drone manufacturers to remain competitive.

The Trump administration is making American UAS production a priority through the power of executive orders—including orders to bolster drone defense technology and mandate US-made systems for government and law enforcement applications.

Taken together, the orders aim to boost struggling American drone makers, wean the U.S. off Chinese drones and defend the country against small aircraft that are playing increasingly important roles in business, public safety and military operations.

The orders are the first presidential directives aimed at the drone industry. In calling for more innovation at home and pushing for widespread adoption of made-in-America aircraft, they acknowledge the fragile state of the U.S. drone industry, which has struggled to produce large numbers of capable and affordable drones.

“Well-Played in USA: Why Onshoring Makes Good Business Sense” INDUSTRY WEEK

Bill Banta, CEO of American truck storage solutions company Decked, provides his take on the benefits of reshoring:

In this environment, onshoring—bringing production back to the United States—isn’t just a patriotic gesture; it’s a strategic imperative. I’m saying that as a manufacturer.

Committing to a Made-in-America strategy, even if only for a subset of your business, accelerates the innovation flywheel. Building close relationships with supply-chain partners and sourcing materials domestically enables companies to shorten supply lines, adapt faster to customers and improve products quickly.

Across the country, pockets of specialized expertise exist, from advanced machining in the Midwest to aerospace innovation in the South. Successful domestic companies tap into these localized talent pools, grounding operations where the right skills already thrive.

Decked makes cool stuff. We keep meaning to have him on the TOOL OR DIE podcast, but have been trying to widen our aperture outside of our beloved off-road and 4x4 favorites. Maybe we should take a swing back through Truck Stuff and get Bill on the show.

“Illinois awards $1.35M to boost small, mid-sized manufacturers statewide” ABC20

The grants, offering up to $50,000 per project, aim to boost innovation, productivity, and competitiveness. In total, the funded projects represent more than $38.3 million in investments and support over 1,100 jobs.

The State of Illinois also has a Tariff Resource Center, providing businesses with up-to-date information to help them navigate ongoing international trade disputes.

“Made in America Directory” ALLIANCE FOR AMERICAN MANUFACTURING

A useful directory for finding American-made products, searchable by state or product category.

Getting MITUSA back en vogue—and not making it seem like something purely right-coded—is one of our aims with TOOL OR DIE. (And a good learning experience, too: we’re still working on merch, but taking our time to not just buy the first MITUSA option we find—we’re a business, too.)