HIGH MIX: Smart Fridges, Transformers and AI Lego Bots

Reindustrialization news for August 18, 2025

Welcome to HIGH MIX, our weekly newsletter about the reindustrialization of the United States.

“GE Appliances to invest $3B in US manufacturing” MANUFACTURING DIVE

A $3 billion investment by GE Appliances could be a net positive in the U.S. appliance industry, but the quiet force behind it—China’s Haier—deserves a closer look. Haier is steering a significant portion of this five-year plan, which includes expanding 11 U.S. plants across Kentucky, Alabama, Georgia, Tennessee, and South Carolina.

Haier. originally known for its refrigerators and washing machines, has its roots in Qingdao, and has been GE Appliances’ owner since 2016 since acquiring the division from General Electric for $5.4 billion.

This investment, the second-largest in GE Appliances’ history, aims to reshore production (surprisingly) from China and Mexico, create 1,000 new jobs, and boost output in water heaters, air conditioners, and refrigerators. Yet, Haier’s role raises intriguing questions about the intersection of foreign ownership and American industrial policy.

Haier’s “zero-distance” approach—bringing manufacturing closer to consumers—aligns with Trump’s tariff-driven reshoring push, potentially softening trade pressures. Direct foreign investment to U.S. manufacturing is welcome and often a logical margin maker, although ultimately the revenue still leaves our shores.

And its IoT ecosystem, occasionally lauded for innovations in things like smart refrigerators, raises concern over data privacy. (As should essentially all “smart home” devices, no matter the origin country.) The 2024 takedown of Home Assistant plugins for Haier appliances, sparking a community backlash with over 1,300 forks on GitHub, highlights tensions over control and open-source integration. This incident, tied to Haier’s push into smart appliance technology, suggests a focus on proprietary systems that might clash with U.S. innovation norms.

Other Chinese firms that sell consumer goods to Americans have been following similar post-launch lock-in strategies for their software (3D printer company Bambu Labs, motorcycle manufacturer CFMOTO) which we inherently oppose—if you buy something you own all of its capabilities, not just those locked behind monthly subscriptions—a strategy they have arguably learned by watching the moves of American tech companies.

In the end, the profits flow back to China: how do we measure trading the creation of American-owned companies in the long-term for the benefit of short-cycle jobs?

“PRC Industrial Policy in the U.S.-China Semiconductor Chip Competition” CHINA US FOCUS

What is China’s aggressive “Delete America” industrial policy?

Launched via SASAC Document 79 in 2022, this policy aims to purge foreign technology, notably U.S. chips, from Chinese systems by 2027, supported by the National Integrated Circuit Industry Investment Fund’s $95 billion across three rounds, including a $48 billion infusion in May 2024.

This state-backed push has propelled China to dominate 39% of the global legacy chip market (28nm and above) by 2027 projections, outpacing combined global capacity growth. It’s a calculated move to reduce reliance on American tech—where China still sources 80% of high-end AI chips from Nvidia—while fostering domestic players like Huawei.

“MIT gears up to transform manufacturing” MIT NEWS

MIT want to reshape how we make things with the Initiative for New Manufacturing (INM), and its value to the country is noteworthy. INM, led by John Hart, Suzanne Berger, and Chris Love, leverages cutting-edge technologies like AI and automation. Backed by founding members GE Vernova and Siemens with $500,000 annual contributions, this program aims to modernize industries from batteries to textiles, offering American companies an edge.

The program’s value aims to distinguish itself by collaborating with community colleges and corporations to train a skilled workforce, addressing growing manufacturing job vacancies with hands-on learning at MIT.nano’s shared labs. The $275,000 annual membership fee fosters a network of industry leaders (and keeps out small players, for better or worse), driving advancements that enhance competitiveness. By equipping workers with expertise in automation and AI, INM feeds the talent pipeline.

“Transformer troubles: manufacturing and policy constraints hit US transformer supply” WOOD MACKENZIE

Transformers—critical for stepping up and down voltage across power grids—face a 30% supply deficit for power units and 6% for distribution transformers, driven by a 7% surge in electricity demand since 2020, fueled by data centers, manufacturing growth, and electrification.

With 55% of the 40 million in-service distribution units over 33 years old, the grid’s aging backbone amplifies urgency. The consensus seems to be this as a solvable bottleneck, but the data suggests a deeper structural challenge: domestic production lags, with imports now covering 80% of power transformers and 50% of distribution units. This reliance questions the narrative of a self-sufficient reindustrialization—can America truly lead if its grid hinges on foreign supply?

Supply chain woes dominate the analysis. Since 2019, demand for power transformers has soared 116% and generation step-up units 274%, while distribution units grew 30-80% depending on specs. Yet, manufacturing capacity hasn’t kept pace, exacerbated by raw material shortages—grain-oriented electrical steel (GOES) prices hit record highs, with the U.S. leaning on a single supplier, AK Steel—and copper bottlenecks, worsened by 50% tariffs.

Labor shortages further choke output, as specialized skills remain scarce, and the lack of standardization forces custom builds, inflating lead times. The report notes $1.8 billion in OEM capacity expansions since 2023, but this feels like a band-aid on a gushing wound—demand growth outstrips investment, suggesting a market misjudgment of scale.

Policy adds another layer of complexity. Trump’s “One Big Beautiful Bill” cuts clean energy support, potentially easing step-up transformer demand, yet new tariffs—especially on copper—drive costs up 45-95% since 2019, with power transformers seeing a 77% spike.

Where’s the Gundo Bro venture-backed startup for transformers?

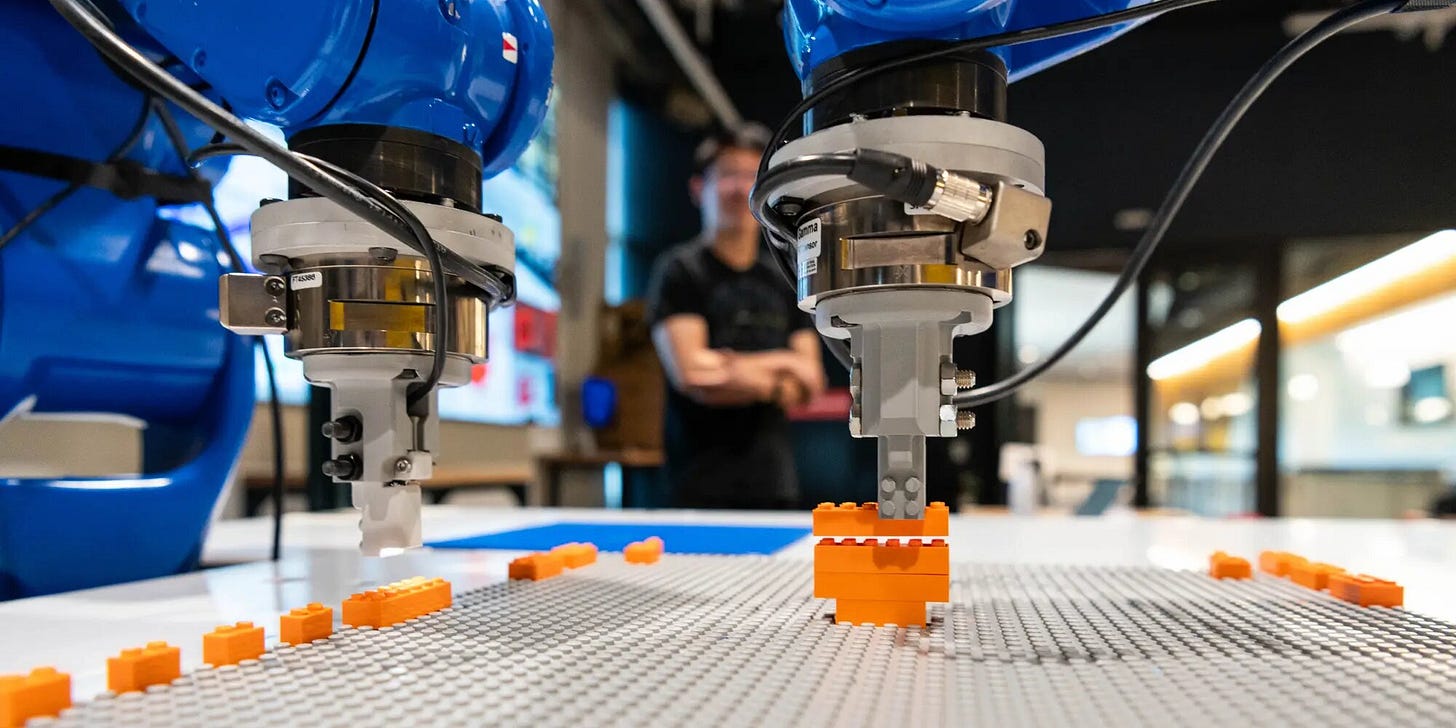

“The AI tool that could make manufacturing faster and more efficient—by using Lego bricks” TECH X PLORE

Carnegie Mellon University’s BrickGPT is hardcore mode for building with Legos. This AI-powered tool, developed by their School of Computer Science, turns simple text prompts like “guitar” or “sofa” into step-by-step guides for building stable, physical models—usable by humans or robots. It’s a visionary (and fun) step toward generative manufacturing, where anyone can design and build everyday objects, from chairs to toys, with unprecedented speed and precision.

BrickGPT, trained on the StableText2Brick dataset with over 47,000 structures, uses an autoregressive model to predict stable brick placements, ensuring designs won’t collapse.

“Anduril opens solid rocket motor factory amidst ongoing chemical chokepoint” TECH CRUNCH

Anduril’s launch of a high-volume solid rocket motor (SRM) factory in Mississippi brings new competition to defense industry, but it’s a story of ambition tempered by vulnerability.

The facility, operational with 700 motors test-fired, aims to produce 6,000 tactical motors annually by 2026, challenging the Northrop Grumman-L3Harris duopoly. Backed by a $75 million investment and a $14.3 million Defense Production Act grant, this move addresses surging defense demands—driven by Ukraine and South China Sea tensions—positioning Anduril as the third U.S. SRM supplier. It’s critical defense tech, but there’s a glaring hitch: the ammonium perchlorate (AP) supply bottleneck.

Jerry McGinn, a former senior industrial base official in the Department of Defense, said the need for multiple suppliers of AP dwindled as the demand for SRMs collapsed in the 1990s. The Pentagon backed a “merger-to-monopoly” in the 1990s, preferring to have one healthy provider rather than two struggling companies that couldn’t be competitive without government subsidies, he said.

AP, the essential oxidizer, comes from a single U.S. producer, AMPAC in Utah. Northrop’s $100 million AP supply line attempt struggles with certification delays, and AMPAC’s $100 million expansion to boost capacity 50% by 2026 is almost out of time. This monopoly, a legacy of the 1990s “merger-to-monopoly” policy, exposes a fragile link—any disruption could stall production.

“Heat check: Researchers study impact of fans on Louisiana factory floor workers” NOLA.COM

Yes, fans really do keep you cool.

A new study from the National Institute for Occupational Safety and Health (NIOSH), examines how industrial fans can mitigate heat stress on Louisiana factory floors—a topic with growing urgency amid rising temperatures.

Conducted in collaboration with Australian researchers at a Baton Rouge facility, the research found that strategically placed high-velocity fans reduced heat exposure by up to 15% for workers, particularly in areas with poor ventilation. This aligns with OSHA’s push to address heat-related illnesses, which spiked 20% in Louisiana manufacturing since 2022, costing firms an estimated $5 million annually in lost productivity.

The findings offer practical insights. Fans, paired with hydration stations, lowered core body temperatures by 0.5°C on average, a threshold that could prevent heat exhaustion during 10-hour shifts in 90°F+ conditions. The study focused on a chemical plant, where fans were adjusted to avoid disrupting sensitive processes, suggesting adaptability across sectors like steel or food processing.

As proud Americans, we love our air-con, but people really do sleep on the benefits simply moving air around can bring.

“How a nonprofit is helping the un- and underemployed fill open manufacturing jobs” CBS NEWS

Offering free, three-week career classes, nonprofit Magnet equips the unemployed and underemployed with soft skills and job connections, already placing 3,000 workers in Ohio. CEO Ethan Karp’s vision tackles barriers like childcare and transportation, ensuring their workers thrive.