HIGH MIX: Winnebagos, Guitar Strings and our Manufacturing Ethos

Reindustrialization news for July 28, 2025

Welcome to HIGH MIX, our weekly newsletter about the reindustrialization of the United States.

“How to see behind the scenes at RV manufacturing plants” USA TODAY

Hit the road, folks, and tour some RV manufacturing plants. Factories like Winnebago in Iowa, Airstream in Ohio and Forest River in Indiana have been opening their doors to curious travelers since June.

The Midwest is the epicenter of America’s recreational vehicle (RV) industry. Airstream is headquartered in western Ohio, and 80 percent of the nation’s RVs are produced in northwest Indiana, earning it the title of “RV Capital of the World.”

These tours, running through August, let you peek at the assembly lines making tons of campers—Winnebago’s Forest City plant alone pumps out 200 RVs monthly.

These plants are part of a $10 billion industry revival, fueled by a post-pandemic RV boom and a reshoring nudge.

Pack your curiosity for propane refrigerators; it’s a chance to see American craftsmanship up close, with guides giving you an hour-long tour for free.

“A Couple Works to Save Paul Revere’s Company” WSJ

Revere Copper Company is channeling the independent spirit of its namesake, the Revolutionary War hero and metallurgist who pioneered American rolled copper sheathing for naval applications. With a new $300 million copper mine in Arizona—launched under Trump’s 50% tariffs set for August 1—this move revives the patriot’s legacy of self-reliance.

Descended from Revere’s 18th-century Boston foundry, which cast cannons for the Continental Army, the company now plays a key role in our self-sufficiency, aiming to produce 50,000 tons annually for U.S. manufacturers.

In the largely dismal U.S. copper industry, after decades of struggles, the company is growing. It is adding equipment to its new plant in Mebane, N.C., to triple output of copper bars. It’s a bet that demand for bars used in electrical equipment will keep exploding due to the construction of computer data centers with their big demand for electricity and other electrical infrastructure.

WSJ mentions a few hurdles like untested deposits, while Arizona’s water scarcity also looms as a silent saboteur. China, with its history of price-slashing in trade spats, will still be a source of pressure as well as German copper plate importers.

“Volkswagen Teases Made-in-America Audis After $1.5 Billion Tariff Hit” WSJ

Volkswagen’s $1.5 billion tariff hit in Q1 2025 has forced a pivot to investing in U.S. manufacturing, including a potential American-made Audi lineup. With a 29% profit drop to €3.83 billion in Q2 and guidance slashed to a 4-5% operating return, VW is eyeing a lifeline: moving Audi manufacturing stateside.

On Friday, Volkswagen Chief Executive Officer Oliver Blume said a deal between the company and the Trump administration would follow an EU-level agreement and be centered on factory and other investments that the world’s second-largest automaker by sales could make in the U.S.

“What we can offer is clear to the U.S. government. It’s a scalable package, which in the end of course will depend on what we get in return,” he said.

The company’s Chattanooga, Tennessee plant—already producing ID.4 EVs and Atlas SUVs—stands as a $2 billion testament to its U.S. commitment, bolstered by a 2023 expansion. Now, VW dangles an offer to the White House: they’ll bring production of Audi’s Q5 and Q6 e-tron here too, dodging the 27.5% tariff wall, in exchange for tariff relief on its vehicle imports.

“US Core Capital Goods Orders Decline Amid Policy Uncertainty” BLOOMBERG

US core capital goods orders took a hit in June, dropping 0.7% after a revised 2% gain in May. This unexpected decline, amid trade and tariff uncertainty, signals caution from manufacturers. Orders for durable goods, including aircraft and military gear, plummeted 9.3%.

Yet this stumble could be a hidden opportunity, giving ample time to rethink reshoring strategies as companies brace for Trump’s tariff waves.

Economists like Bloomberg’s Eliza Winger are blaming tariff ambiguity for dampening investment, but let’s question that for a second.

The report shows core shipments rose 0.4%, suggesting some resilience, while Boeing’s June order slowdown might skew the numbers—hardly a full retreat. It also glosses over how China’s 30% EV market surge in Europe might be siphoning investors’ focus from the U.S., a factor worth probing.

However, policy uncertainty is real—Trump’s tariff flip-flops, like the EU’s July 9 reprieve, keep businesses guessing.

“Inside a US guitar string maker's strategy to navigate the trade war” REUTERS

D’Addario & Company, the family-run guitar string giant based in Farmingdale, New York, is wrestling with the trade war. This Reuters piece dives into their “trade war task force,” a weekly meeting born out of the chaos when tariffs first hit hard in April—back then, they were huddling daily.

The company, with $235 million in annual sales and six U.S. factories, is feeling the pinch: a $2.2 million tariff hit this year, up from $700,000 last year.

Their plan is unique: setting up a free trade zone inside their factory premises and rerouting shipments to dodge costs—they’ve shifted Chinese goods directly to international clients, bypassing their Long Island warehouse, and are leaning on suppliers to handle smaller orders.

“Silicon Valley’s $4 Billion Gamble on Defense Manufacturing” BLOOMBERG

Silicon Valley’s latest obsession—pouring $4 billion into defense manufacturing—is a gamble that’s raising eyebrows as much as it’s stirring hope. This report spotlights startups like Neros Inc. and Saronic Technologies, betting big on reindustrializing America’s defense base.

Neros is making drones in a new Southern California factory, aiming for 10,000 monthly by year-end, despite orders for just 36,000 from Ukraine. Saronic’s dropping $2.7 million on a shipyard revival, targeting a WWII-scale output, yet holds only $33 million in federal contracts.

Private capital—$70 billion since 2023—is outpacing the Pentagon’s $4 billion in commitments, driven by Trump’s push to bulk up defense spending.

Dig deeper, and the cracks begin to show. These startups are building factories before securing demand, a risky move framed as visionary. Neros’ CEO admits the supply chain is the bottleneck, yet the article glosses over whether this preemptive sprawl will pay off or just bloat overhead. Saronic’s doubling to 700 employees hinges on contracts that might never materialize, a bet on political promises over proven markets.

If the feds drag their feet or China outpaces with cheaper tech, it’s a $4 billion misfire.

“Old-school manufacturing is gone and is not coming back” SEATTLE TIMES

Written by a self-proclaimed futurist, this op-ed argues that automation and globalization have killed the era of hands-on factory jobs, painting a picture of a lost past with no resurrection.

The author cites a 30% drop in traditional manufacturing jobs since 2000 and claims AI will render human labor obsolete, dismissing reshoring as a nostalgic fantasy. It’s a convenient narrative, but it’s riddled with holes.

First, the stats don’t tell the whole story. That 30% job loss ignores the 287,000 new positions from reshoring and foreign investment in 2023 alone, a trend the op-ed conveniently skips.

The author’s AI obsession—predicting a fully automated future—overlooks how companies like Ford are retraining workers for smart factories, not replacing them. The piece sneers at “nostalgia” for steel mills, yet it sidesteps how states like Ohio have seen $10 billion in factory investments since 2022, breathing life into those “old-school” roots.

The op-ed’s claim that globalization is irreversible crumbles when you consider Trump’s 50% tariff push, forcing supply chains to rethink their reliance on China.

Manufacturing isn’t dead; it’s evolving, with reshoring potentially reclaiming 10% of global production as soon as 2030 if we adapt, not abandon.

The author’s defeatist tone dismisses the grit of American workers who are proving old-school spirit can thrive with new tech. Unless we buy this premature eulogy, the revival’s just getting started—don’t let visioneers bury it prematurely.

“Recognizing a ‘manufacturing hero’” NORTHEAST TIMES

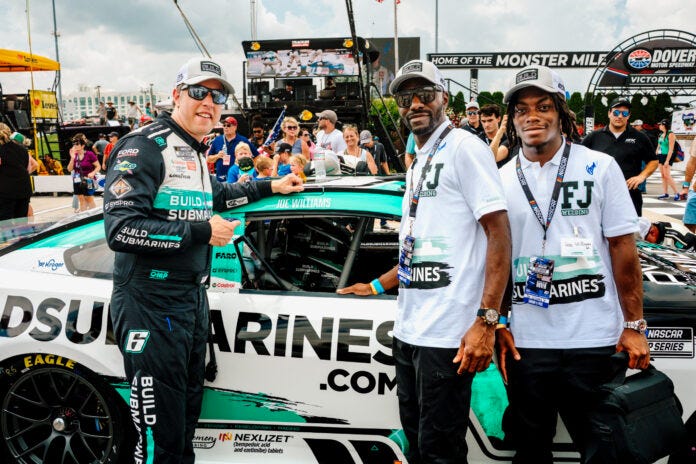

Joe Williams, a welder who’s shaped ships and submarines with his hands for 40 years, is now mentoring the next generation alongside his son as director of the Connolly Welding Lab at Father Judge High School.

Williams thanked school president Brian King for his vision in creating the Career Pathways Academy building, which houses welding, automotive (which began last year) and HVAC (which kicks off this fall).

Over three years, welding students complete 1,080 hours of study and learn the four common welding processes. To be considered, students must have good grades, conduct and attendance.

The reward is great, Williams said. Welding is a high-demand, high-wage career, he said. Graduates receive job offers that start with a high annual salary that climbs to six figures in a few years and ends later with a nice pension and early retirement.

The photo of Joe with his son and Brad Keselowski, the NASCAR star turned manufacturing advocate, captures real pride.

“Places like Taiwan dominate chipmaking because they value ‘high-quality’ manufacturing, an ethos that ‘doesn’t exist in North America’” FORTUNE

Fortune’s take on chipmaking wants us to swallow a dubious pill: Taiwan and South Korea rule the semiconductor world because they’ve got some mystical “high-quality” manufacturing ethos, while America’s apparently clueless.

Nigel Toon of Graphcore claims this cultural edge drives their dominance, pointing to supply chain shocks and AI’s demand for semiconductors as proof we’re doomed without their model. They suggest North America lacks the sophistication to match Taiwan’s TSMC or Korea’s Samsung, despite U.S. subsidies pouring billions into reshoring.

This “ethos” narrative is baseless. Fortune ignores how Taiwan and Korea’s lead stems from decades of government handouts and cheap labor—hardly a cultural triumph. Toon’s claim that North America can’t replicate this glosses over Intel’s (delayed) $20 billion Ohio fab under construction, or TSMC’s own $65 billion Arizona factory, proving the U.S. semiconductor industry is steadily growing.

They lean on COVID-era supply woes to justify reshoring failures, but ignore how U.S. policy shifts—like the CHIPS Act’s $52 billion—have already lured $200 billion in commitments since 2022. The article’s defeatist tone underestimates American competency; Taiwan’s edge is eroding as we build, not bow out.

“America’s Top States for Reshoring Jobs” GLOBE STREET

This list crowns Texas as the reshoring king, adding 40,200 jobs—nearly a quarter of the 161,200 total across the top 20 states—thanks to heavy investments like Samsung’s $65 billion and Tesla’s $5.5 billion.

South Carolina follows with 24,800 jobs, Mississippi with 12,100, New Mexico with 9,800, and Michigan with 8,700.

Industries like computers (68,700 jobs) and transportation (52,500) lead the charge, with companies like Walmart promising 300,000 jobs.

Texas leads with its tech and auto surge, while South Carolina’s automotive growth could be a new Detroit rising. Mississippi’s steady 12,100 jobs show smaller states can shine, and New Mexico’s 9,800 reflect a diversifying landscape. Michigan’s 8,700 jobs revive its automotive legacy, proving the Rust Belt can gleam again.

“Trump's 'big, beautiful bill' sparks investment surge across American businesses” FOX BUSINESS

Trump’s “One Big Beautiful Bill Act” (OBBBA) is igniting investment. The bill, signed July 4, is propelling a “capex comeback” with businesses unleashing capital expenditures thanks to full expensing retroactive to January 2025.

Treasury Secretary Scott Bessent and counselor Joe Lavorgna are calling it a boom, with Pittsburgh’s recent AI summit and Nippon Steel’s $11 billion U.S. Steel deal—promising 100,000 jobs—leading the way. The policy pairs tax cuts with tariffs, aiming to lure production home, and early signs show Q2 business equipment production soaring.

The administration sees tariffs and tax breaks as a perfect duet, but history warns of trade war blowback—China’s 30% manufacturing market share won’t fade quietly. The bill’s energy is palpable, but success depends on turning promises into steel and silicon.

“Palmer Luckey asks if you'd pay 20% more for a laptop entirely made in the US” TECHSPOT

Palmer Luckey, the man behind Oculus and now Anduril’s fearless leader, is at it again—and I’m all in. Luckey’s polling whether we’d shell out 20% more for a Made in America PC, a move that shows his passion for bringing tech jobs home.

Luckey also said that he'd had "conversations with everyone you would need to have to do this. Both on the chip side, on the assembly side, the manufacturing side. I know exactly how to do it. What it would cost. How long it would take."

Luckey did say that he hopes somebody else makes a US-manufactured laptop before Anduril does as there's "no reason" for his company to be the first, "unless it's truly not going to be done by anyone else."

Known for revolutionizing VR and now arming the Defense Department with AI drones, he’s tossing out the idea via Anduril, hinting at a laptop that’s 100% U.S.-made.

As someone who followed his journey from garage tinkerer to industry titan, I love to see this aligning with the manufacturing revival we’ve been rooting for with Tool Or Die.

Luckey’s track record backs this up. Anduril’s already proving U.S. manufacturing can compete, making futuristic military hardware that’s outpacing some foreign rivals. And his personal projects like ModRetro are hardware-centric. This could tap into a market worth tens of billions if it takes off, and I believe it—his knack for innovation could pull the American computer industry into the future.